i-80 Gold Reports High-Grade Drill Results from the FAD Deposit at Ruby Hill

9.0 g/t Au, 92.4 g/t Ag, 12.2 % Zn & 1.0 % Pb over 14.6 m

3.9 g/t Au, 185.6 g/t Ag, 11.1 % Zn, & 3.6% Pb over 25.4 m

Reno, Nevada, January 25, 2024 – i-80 GOLD CORP. (TSX:IAU) (NYSE:IAUX) (“i-80”, or the “Company”) is pleased to announce high-grade results from the 2023 drill program completed at the FAD deposit situated on the Company’s 100%-owned Ruby Hill Property (“Ruby Hill” or “the Property”) located in Eureka County, Nevada.

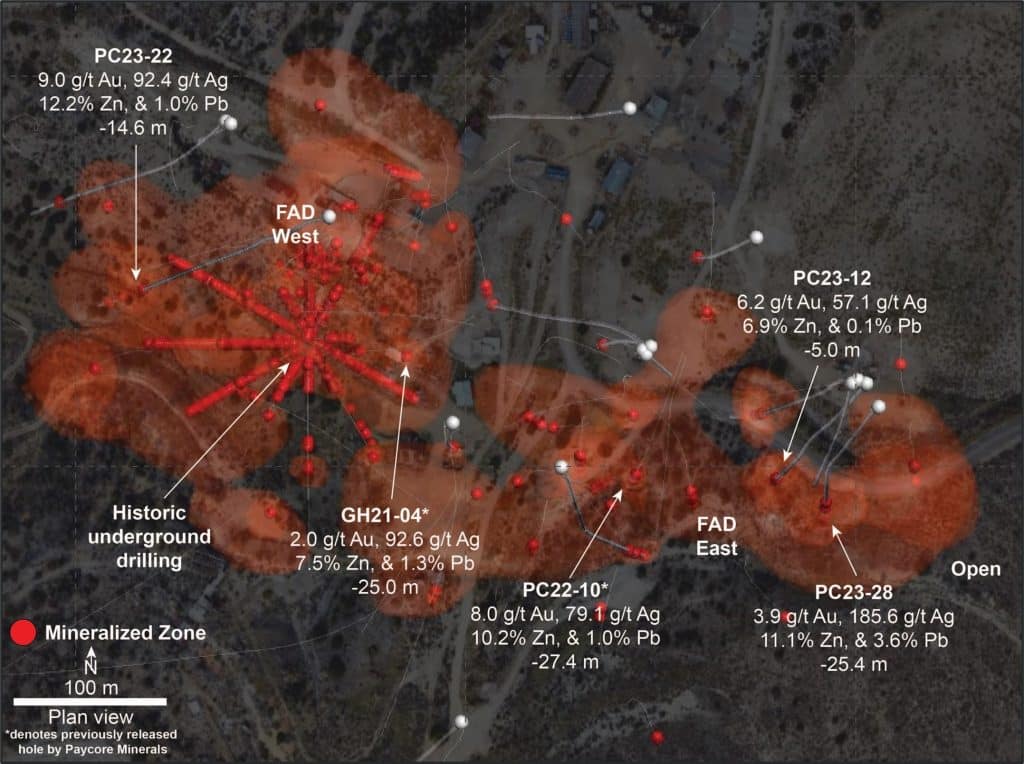

FAD is one of several polymetallic deposits drilled at Ruby Hill in 2023 for the completion of initial resource estimates for the FAD, Blackjack and Hilltop deposits. The Ruby Hill Property represents the core land package within the Eureka District of Nevada, one of the world’s premier re-emerging Carbonate Replacement Deposit (CRD) districts. FAD is a high-grade polymetallic deposit and is expected to add to the Company’s already impressive resource base. New results have intersected multiple stacked zones of mineralization in the southeast portion of the deposit.

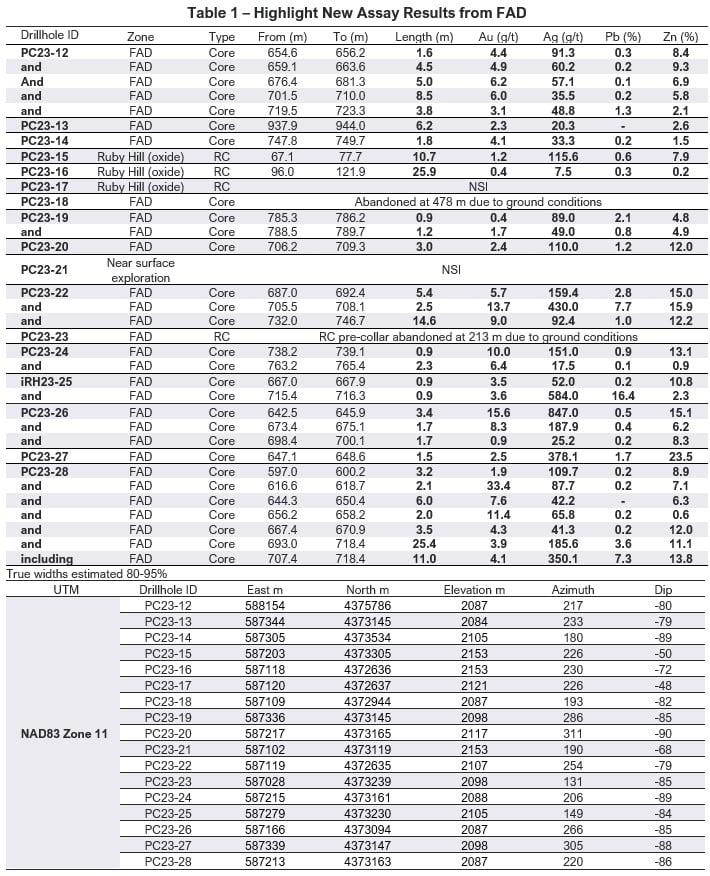

Highlight drill results from 2023 drilling at FAD:

PC23-12 – infill hole in the east FAD lobe 50 m northwest of PC23-28 (5 zones)

- 4.4 g/t Au, 91.3 g/t Ag, 8.4% Zn & 0.3% Pb over 1.6 m

- 4.9 g/t Au, 50.2 g/t Ag, 9.0% Zn & 0.2% Pb over 4.5 m

- 6.2 g/t Au, 57.1 g/t Ag, 6.9% Zn & 0.1% Pb over 5.0 m

- 6.0 g/t Au, 35.5 g/t Ag, 5.8% Zn & 0.2% Pb over 8.5 m

- 3.1 g/t Au, 48.8 g/t Ag, 2.1% Zn & 1.3% Pb over 3.8 m

PC23-22 – infill hole drilled on the western margin of the west FAD lobe (3 zones)

- 5.7 g/t Au, 159.4 g/t Ag, 15.0% Zn & 2.8% Pb over 5.4 m

- 13.7 g/t Au, 430.0 g/t Ag, 15.9% Zn & 7.7% Pb over 2.5 m

- 9.0 g/t Au, 92.4 g/t Ag, 12.2% Zn & 1.0% Pb over 14.6 m

PC23-26 – step-out hole 50 m north of PC23-12 on the east FAD lobe (3 zones)

- 15.6 g/t Au, 847.0 g/t Ag, 15.1% Zn & 0.4% Pb over 3.4 m

- 8.3 g/t Au, 187.9 g/t Ag, 6.2% Zn & 0.4% Pb over 1.7 m

- 0.9 g/t Au, 25.2 g/t Ag, 8.3% Zn % 0.2% Pb over 1.7 m

PC23-28 – final hole and furthest hole drilled to the east in the east FAD lobe (6 zones)

- 1.9 g/t Au, 109.7 g/t Ag, 8.9% Zn & 0.2% Pb over 3.2 m

- 33.4 g/t Au, 87.7 g/t Ag, 7.1% Zn & 0.2% Pb over 2.1 m

- 7.6 g/t Au, 42.2 g/t Ag, & 6.3% Zn over 6.0 m

- 11.4 g/t Au, 65.8 g/t Ag, 0.6% Zn, & 0.2% Pb over 2.0 m

- 4.3 g/t Au, 41.3 g/t Ag, 12.0 % Zn & 0.2% Pb over 3.5 m

- 3.9 g/t Au, 185.6 g/t Ag, 11.1% Zn & 3.6% Pb over 25.4 m including 4.1 g/t Au, 350.1 g/t Ag, 13.8% Zn & 7.3% Pb over 11.0 m

The Eureka District has a long and successful history of mining, extending over a period of one hundred sixty years (1864-Present) including some of the world’s highest-grade CRD mines. From 1866 until 1967 the Ruby Hill district produced an estimated 2 Mt of ore containing approximately 1.65 Moz Au, 39 Moz Ag, and 625M lbs of lead. It is estimated 80% to 90% of this production came from the original Ruby Hill Mine, located 500 metres southwest of the FAD deposit[i].

The FAD deposit Is located in the hanging-wall of the Ruby Hill fault and is comprised of dominantly sulfide, polymetallic mineralization (see Figure 2). Drilling completed in 2022 and 2023 has successfully intersected multiple horizons of mineralization that remain open for expansion. Results compliment previously released holes drilled by Paycore that include:

- 7.8 g/t Au, 155.5 g/t Ag, 22.0% Zn & 1.5% Pb over 12.5 m (PC22-07)

- 7.1 g/t Au, 376.3 g/t Ag, 6.3% Zn & 10.3% Pb over 14.8 m (PC22-08A)

- 8.0 g/t Au, 79.1 g/t Ag, 10.2% Zn & 1.0% Pb over 27.4 m (PC22-10)

In addition to the deeper sulfide mineralization at FAD, drilling tested proximal to the historic Ruby Hill Mine. These holes intersected low-grade oxide mineralization suggesting the potential to delineate near-surface mineralization proximal to historic workings that may be amenable to open pit mining.

“The drill program at FAD compliments successful programs on the Blackjack and Hilltop deposits and our expanded focus on exploring for polymetallic mineralization in the Eureka District to better assess the economic opportunity.”, stated Tyler Hill, Chief Geologist of i-80 Gold. “FAD is unusual in comparison to global CRD deposits given its elevated gold grades.”

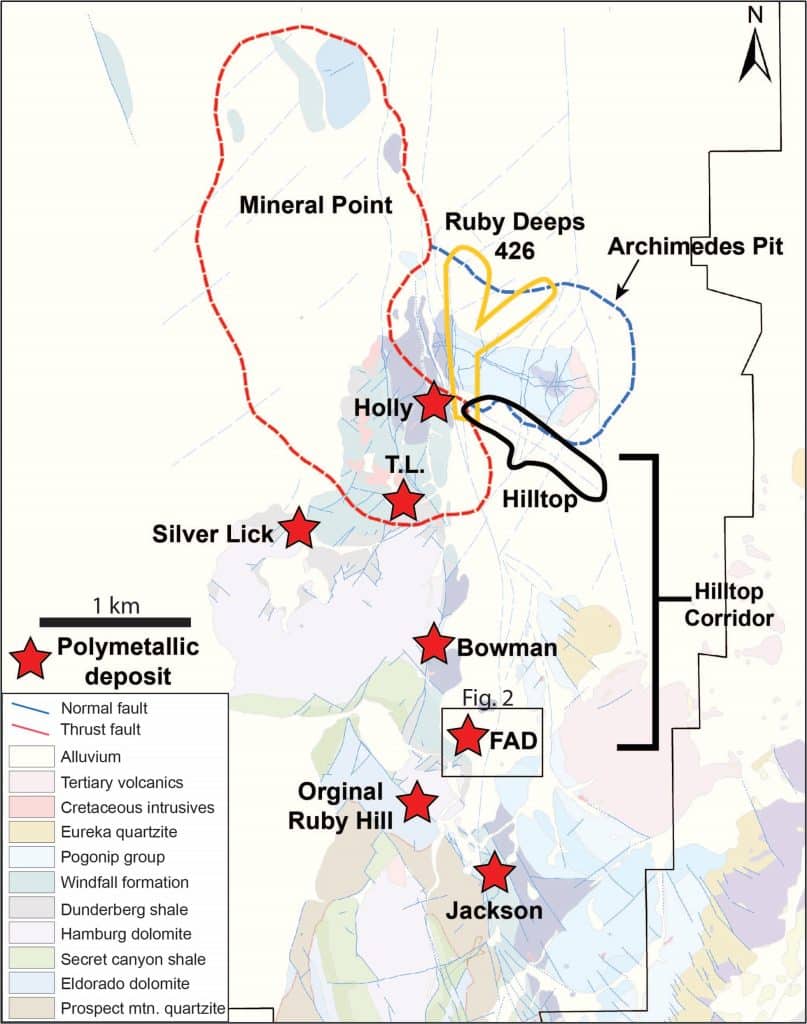

The FAD deposit is located within the “Hilltop Corridor” approximately 2 km south of the Hilltop discovery made by i-80 in mid-2022. Multiple drill rigs were active in 2023, aggressively defining and expanding mineralization at Hilltop, now having identified a series of high-grade CRD zones located on the south side of the Archimedes pit (see Figure 1). Previously released results from drilling at Upper Hilltop include 515.3 g/t Ag, 28.9 % Pb, 10.5 % Zn & 0.9 g/t Au over 28.3 m in hole iRH22-43, 1.9 g/t Au, 631.3 g/t Ag, 7.4 % Zn & 33.0 % Pb over 18.3 m in hole iRH22-53, 14.7 g/t Au, 253.3 g/t Ag, 0.4% Zn & 8.7% Pb over 7.5 m in hole iRH23-52 and 0.6 g/t Au, 332.9 g/t Ag, 8.8% Zn & 18.8% Pb over 32.0 m in hole iRH23-54. Recent results from drilling in the East Hilltop Zone include 1.5 g/t Au, 274.6 g/t Ag, 4.7% Zn & 4.3% Pb over 13.2 m in hole iRH23-48, and 9.5% Zn, 0.3% Cu & 12.6 g/t Ag over 114.3 m including 17.7% Zn, 0.4% Cu & 10.2 g/t Ag over 36.6 m in iRH23-50.

The Hilltop Corridor is a 2 km long (see Figure 1), alluvial covered, trend immediately south of the Archimedes pit believed to be host to multiple feeder fault structures that is largely untested by previous drilling owing to the alluvial cover. The Hilltop discoveries were made in the second half of 2022 exploration campaign while testing one of several generative exploration targets identified proximal to the Blackjack (skarn) deposit, with mineralization defined along the Hilltop fault structure over a strike length of approximately 750 metres. At the end of the 2023 drill program, one hole was drilled to test for the possible extension of skarn mineralization proximal to the contact of the Graveyard Flats intrusive. This hole, iRH23‑55, intersected a broad zone of skarn mineralization with 4 higher-grade intercepts, including an interval of 1181.0 g/t Ag, 19.5% Zn, 10.2% Pb & 1.2% Cu over 1.5 m.

Drilling was also completed in the Blackjack deposit in 2023, yielding numerous significant results, successfully delineating and expanding high-grade mineralization. i-80 drilling started at hole PC23-22.

Figure 1 – i-80 Ruby Hill Property Geology

Figure 2 – FAD Deposit Plan

Please click here for further information on abbreviations and conversions referenced in this press release.

QAQC Procedures

All samples were submitted to American Assay Laboratories (AAL) of Sparks, NV, which is an ISO 9001 and 17025 certified and accredited laboratory, independent of the Company. Samples submitted through AAL and are run through standard prep methods and analyzed using FA-PB30-ICP (Au; 30g fire assay) and IO‑4AB32 (35 element suite; 0.5g 4-acid ICP-OES+MS). AAL undertakes their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. i-80 Gold Corp’s QA/QC program includes regular insertion of CRM standards (gold and polymetallic), duplicates, and blanks into the sample stream with a stringent review of all results.

Qualified Person

Tyler Hill, CPG-12146, Chief Geologist at i-80 is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company’s advanced-stage property portfolio with processing at i-80’s centralized milling facilities. i-80 Gold’s common shares are listed on the TSX and the NYSE American under the trading symbol IAU:TSX and IAUX:NYSE. Further information about i-80 Gold’s portfolio of assets and long-term growth strategy is available at www.i80gold.com or by email at info@i80gold.com.

For further information, please contact:

Ewan Downie – CEO

Matt Gili – President & COO

Matthew Gollat – EVP Business & Corporate Development

1.866.525.6450

Info@i80gold.com

www.i80gold.com

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including but not limited to, the expansion or mineral resources at Ruby Hill and the potential of the Ruby Hill project. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.