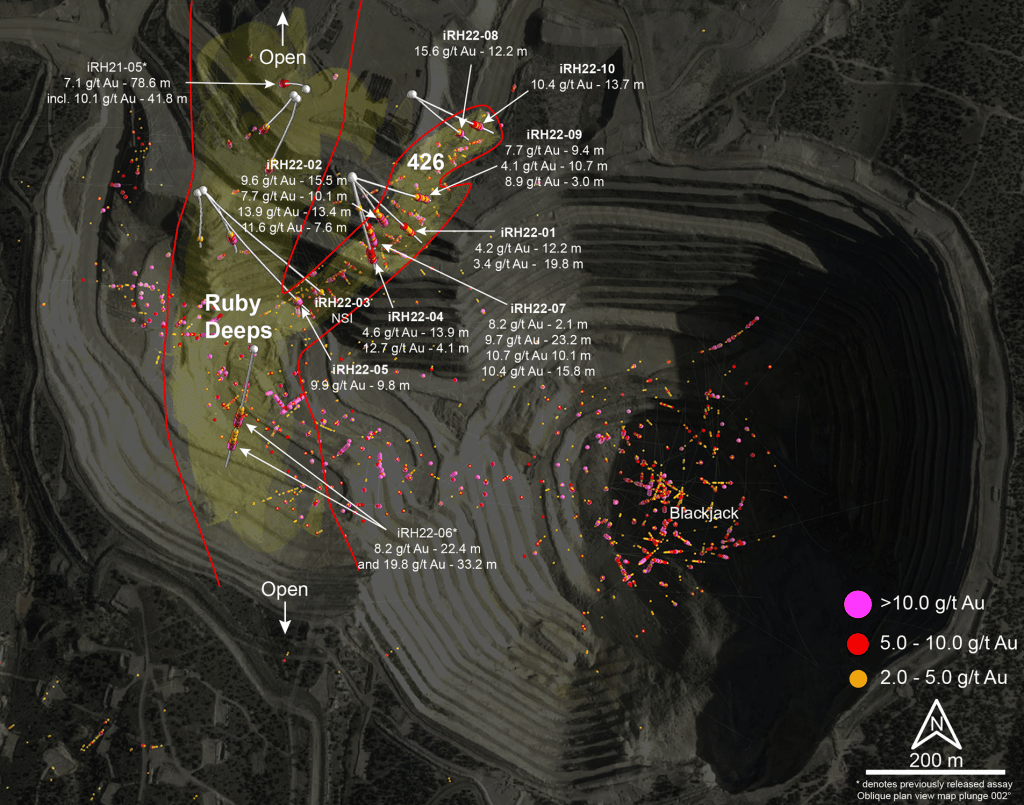

i-80 Gold Reports High-Grade Gold in Drilling at Ruby Hill – 426 Zone

Results Include 13.9 g/t Au over 13.4 m, 9.7 g/t Au over 23.2 m & 15.6 g/t Au over 12.2 m

Reno, Nevada, August 16, 2022 – i-80 GOLD CORP. (TSX:IAU) (NYSE:IAUX) (“i-80”, or the “Company”) is pleased to announce that initial drilling to test the 426 Zone, part of the Ruby Deeps deposit, has intersected multiple zones of high-grade mineralization at the Company’s 100%-owned Ruby Hill Property (“Ruby Hill” or “the Property”) located in Eureka County, Nevada.

Highlight results from initial infill and step-out drilling in the 426 horizon:

iRH22-02 – four intervals:

-

- 9.6 g/t Au over 15.5 m (0.28 oz/ton – 51.0 ft)

- 7.7 g/t Au over 10.1 m (0.22 oz/ton – 33.0 ft)

- 13.9 g/t Au over 13.4 m (0.40 oz/ton – 44.0 ft)

- 11.6 g/t Au over 7.6 m (0.34 oz/ton – 25.0 ft)

iRH22-05

-

- 9.9 g/t Au over 9.8 m (0.29 oz/ton – 32.0 ft)

iRH22-07 – four intervals

-

- 8.2 g/t Au over 2.1 m (0.24 oz/ton – 7.0 ft)

- 9.7 g/t Au over 23.2 m (0.28 oz/ton – 76.0 ft)

- 10.7 g/t Au over 10.1 m (0.31 oz/ton – 33.0 ft)

- 10.4 g/t Au over 15.8 m (0.30 oz/ton – 52.0 ft)

iRH22-08

-

- 15.6 g/t Au over 12.2 m (0.45 oz/ton – 40.0 ft)

iRH22-09

-

- 7.7 g/t Au over 9.4 m (0.22 oz/ton – 31.0 ft), incl. 10.6 g/t Au over 5.3 m (0.31 oz/ton – 17.5 ft)

iRH22-10

-

- 10.4 g/t Au over 13.7 m (0.30 oz/ton – 45.0 ft)

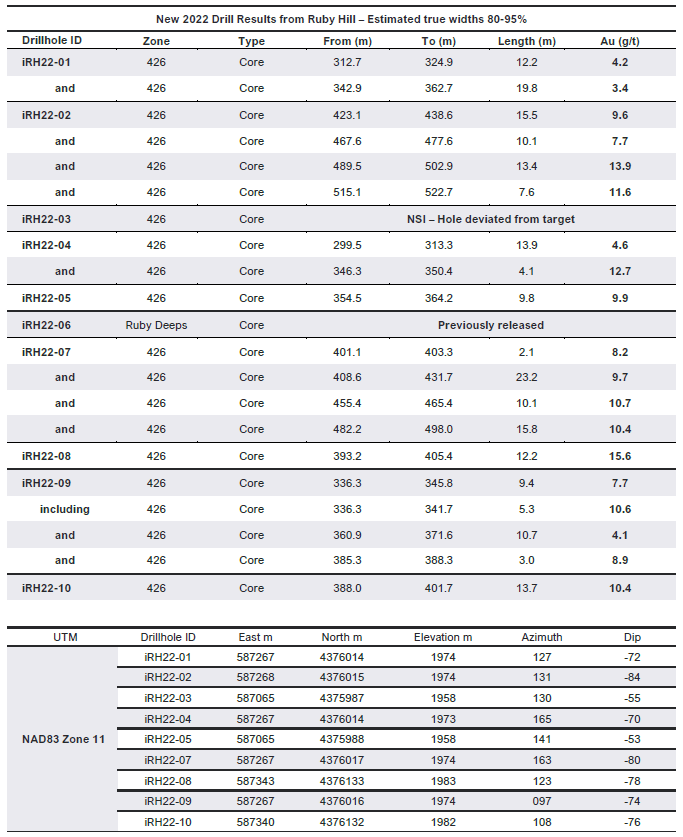

The 426 Zone is the upper portion of the Ruby Deeps deposit, is interpreted to consist of stratigraphic and fault controlled sub-horizontal mineralization hosted within or proximal to the northeast striking 426 fault structure and is anticipated to be the first zone accessed from underground. Drilling in the 426 Zone is designed to define mineralization for initial mine planning, to provide geotechnical work for the design of the underground decline, and to complete additional metallurgical test work. The 426 Zone remains open along strike to the south and at depth with very little drilling existing along the 426 fault at depth above its intersection with the Ruby Deeps. Drill holes iRH22-02 and iRH22-07 each intersected four significant intervals within this gap. Several holes intersected multiple structures, suggesting the potential to define resources in multiple horizons (see Figures 1 & 2 and Table 1) and, as in previous drilling in the Ruby Deeps Zone, ground conditions appear to be very favourable and intersection widths and grades have met or exceeded expectations. Additionally, significant oxide mineralization has been observed in the upper portions of the deposit.

The Company is completing a large-scale surface (+20,000 metre) drill program at Ruby Hill for both deposit delineation and exploration purposes. Definition and expansion drilling is focused on the initial areas planned to be mined including the 426 Zone and the deeper Ruby Deeps Zone where recent results include 19.8 g/t Au over 33.2 m and 7.1 g/t Au over 78.6 m. Multiple gold and poly-metallic exploration targets are also being drilled.

The ongoing infill and step-out drill program will aide in the advancement of the Company’s plan to develop an underground mine at Ruby Hill, accessed via ramp from the Archimedes open pit. Following the 2022 program, an updated mineral resource estimate is planned for the completion of an economic study. The current program at Ruby Hill is one of several ongoing and anticipated drill programs on i-80 projects in 2022 that are collectively budgeted to comprise more than 50,000 metres.

It is expected that refractory mineralization from the planned underground operation at Ruby Hill will be trucked to the Company’s Lone Tree facility, once operational, and oxide mineralization can be processed on-site at the existing heap leach pad, or at the existing CIL plant, once refurbished. i-80’s substantial existing infrastructure at Lone Tree and Ruby Hill is expected to reduce potential exposure to the current inflationary environment.

“The grades of mineralization at Ruby Hill continue to impress as we define one of the premier Carlin-type, gold deposits in Nevada”, stated Ewan Downie, CEO of i-80. “We have a CIL plant at Ruby Hill that could factor into our future processing plans given that we are intersecting appreciable oxidized mineralization in the 426 Zone. Additionally, significant alteration and mineralization has been observed in multiple conceptual exploration targets that have been tested to-date that also include oxidized mineralization.”

Figure 1 – Ruby Hill Oblique Surface Plan

Table 1 – Highlight Assay Results from Ruby Hill 426 Zone

Figure 2 – Cross Section – 426 Zone

The Ruby Hill Property is one of the Company’s primary assets and is host to the core processing infrastructure within the Eureka District of the Battle Mountain-Eureka Trend including an idle CIL plant and an active heap leach facility. The Property is host to multiple gold, gold-silver and poly-metallic (base metal) deposits.

Please click here for further information on abbreviations and conversions referenced in this press release.

QAQC Procedures

All samples were submitted to ALS Minerals (ALS) of Sparks, NV, which is an ISO 9001 and 17025 certified and accredited laboratory, independent of the Company. Samples submitted through ALS are run through standard prep methods and analysed using Au-AA23 (Au; 30g fire assay) and ME-ICP41 (35 element suite; 0.5g Aqua Regia/ICP-AES) for ALS. ALS also undertakes their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. i-80 Gold Corp’s QA/QC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

Qualified Person

Tim George, PE, Mine Operations Manager, reviewed the technical and scientific information contained in this press release and is a Qualified Person within the meaning of NI 43-101.

About i-80 Gold Corp.

i-80 Gold Corp. is a well-financed, Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company’s advanced-stage property portfolio with processing at i-80’s centralized milling facility that includes an autoclave.

For further information, please contact:

Ewan Downie – CEO

Matt Gili – President & COO

Matthew Gollat – EVP Business & Corporate Development

1.866.525.6450

Info@i80gold.com

www.i80gold.com

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including but not limited to, the expansion or mineral resources at Ruby Hill and the potential of the Ruby Hill project. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.