i-80 Gold Reports Q3 2023 Operating Results

Reno, Nevada, November 1, 2023 – i-80 GOLD CORP. (TSX:IAU) (NYSE:IAUX) (“i-80”, or the “Company”) reports its operating and financial results for the three and nine months ended September 30, 2023. i-80’s Consolidated Interim Financial Statements (“financial statements”), as well as i-80’s Management’s Discussion and Analysis of Operations and Financial Condition (“MD&A”) for the three and nine months ended September 30, 2023, are available on the Company’s website at www.i80gold.com, on SEDAR at www.sedarplus.ca, and on EDGAR at www.sec.gov.

Unless otherwise stated, all amounts referred to herein are in U.S. dollars.

Highlights

Third Quarter

- Gold sales of 4,585 ounces at a realized gold price of $1,8951.

- 16,059 tons of oxidized mineralized material sold for proceeds of $4.5 million.

- Commenced shipping of refractory stockpiles to a third party for processing.

- September 30 cash balance of $38 million and $44 million in restricted cash.

- Continued expansion of gold and polymetallic mineralization at Ruby Hill.

- Continued underground core drilling delineation of the CSD Gap and Helen zones at McCoy-Cove (16,789 feet).

- Continued drilling infill holes at South Pacific Zone at Granite Creek (16,144 feet).

- Completed the initial underground exploration drift at McCoy-Cove.

- Completed 3,329 feet of horizontal advance at Granite Creek.

- Completed an equity private placement for gross proceeds of $27.7 million.

- Completed additional financing by extending the Gold Prepay agreement with Orion for gross proceeds of $20 million.

Year to Date

- Gold sales of 11,262 ounces at a realized gold price of $1,9241.

- Completed 2,644 feet of exploration ramp development at McCoy-Cove.

- Completed 5,481 feet of horizontal development at Granite Creek.

- 39,732 wet tons of mineralized material hauled from Granite Creek to third parties for processing under ore processing and toll milling agreements.

- A total of 162,033 feet (core and RC) drilled by the end of the third quarter with multiple positive results to expand mineralization further at Ruby Hill, Granite Creek, McCoy-Cove and the FAD project.

“In the third quarter the Company continued to see impressive drill results from Ruby Hill and McCoy-Cove. In addition, the Company saw an increase in revenue gold ounces sold and tons of mineralized material sold under the Ore Purchase and Sale Agreement. This increase coupled with the completion of the Amended and Restated Gold Prepay Agreement positions the Company to continue to execute on it’s plans”, stated Ryan Snow, Chief Financial Officer of i-80. “We continue to advance exploration and definition drilling at Granite Creek, McCoy-Cove and Ruby Hill and permitting activities at our projects allowing the Company to advance our projects towards the ultimate goal of building a mid-tier Nevada focused producer.”

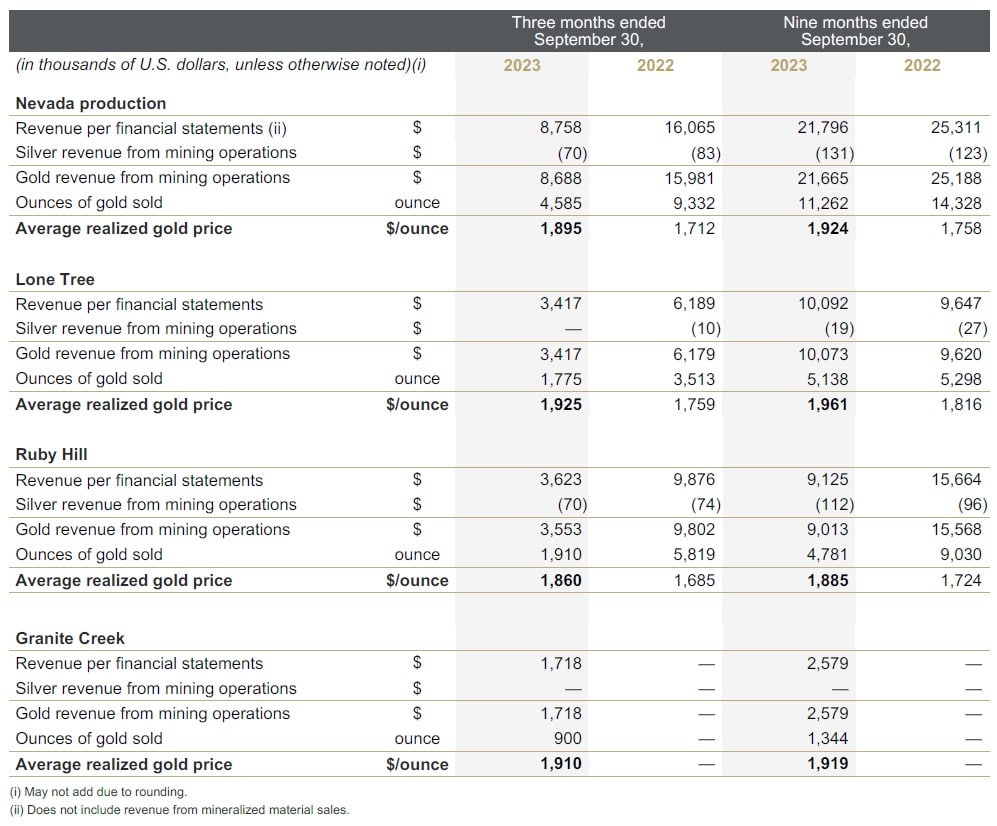

Production and sales totaled 4,585 gold ounces for the quarter and 11,262 gold ounces year to date (YTD) at a realized gold price of $1,895 and $1,924 per ounce sold1, respectively. Additionally, mineralized material sales totaled 16,059 tons for the quarter and 22,710 tons YTD for proceeds of $4.5 million and $7.3 million, respectively.

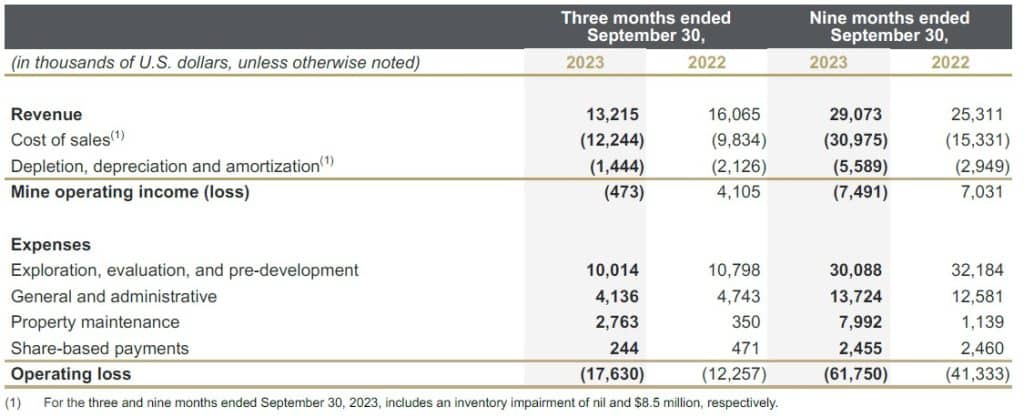

Exploration, evaluation, and pre-development costs were $10.0 million and $30.1 million for the three and nine months ended September 30, 2023. This expenditure mainly reflects the exploration and pre-development work at McCoy-Cove and Ruby Hill.

Lone Tree

Lone Tree is expected to become the hub of i-80’s Nevada operations and the central processing facility for gold mineralization from the Granite Creek, McCoy-Cove and Ruby Hill underground gold deposits. Importantly, Lone Tree is host to infrastructure that, following successful refurbishment efforts, will position i-80 as one of only three companies in the United States capable of processing both oxide and refractory mineralization.

The Company advanced the autoclave engineering study to a level three estimate (FS level). Value engineering on all aspects of projects will commence over the next three months.

Lone Tree produced and sold from its residual leaching activities 1,775 ounces of gold during the quarter and 5,138 ounces of gold YTD at a realized gold price of $1,925 and $1,961 per ounce sold1, respectively.

Granite Creek

Refractory material has been shipped to the Twin Creeks facility for processing under the toll milling agreement that is in place with Nevada Gold Mines LLC (“NGM”). The contractual initial tonnage of refractory mineralized material has been delivered. Starting in Q2 2023, the oxide mineralized material from Granite Creek has been stockpiled and subsequently shipped to a third party as part of the Ore Sale Agreement. During the quarter the Company sold 16,059 tons of mineralized material under the Ore Sale Agreement for proceeds of $4.5 million.

McCoy-Cove

The Cove deposit and the McCoy-Cove Property is expected to be the core asset in the Company’s “hub and spoke” business plan and likely the highest-grade gold deposit in i-80’s portfolio.

Expenditures continued during the quarter on the exploration ramp and hydrology studies, and engineering of de-watering and mining options. During the third quarter the remaining 143 feet of the exploration decline was completed and is being used to drill in the Helen and Gap zones.

Underground delineation drilling continued during Q3 with 16,789 feet of core drilled yielding extremely positive results including from the most recent press release:

- iCHU23-10:

- 14.9 g/t Au over 32.7 m, including 22.8 g/t Au over 14.8 m

- iCHU23-11 :

- 15.7 g/t Au over 22.5 m, including 21.8 g/t Au over 11.5 m; and

- 18.9 g/t Au over 29.3 m, including 27.8 g/t Au over 14.9 m

- iCHU23-12A:

- 27.0 g/t Au & 9.2 g/t Ag over 8.0 m

- iCHU23-14:

- 13.3 g/t Au & 29.2 g/t Ag over 4.0 m

- 10.6 g/t Au & 5.2 g/t Ag over 38.8 m

- 12.8 g/t Au & 7.2 g/t Ag over 2.6 m

- 11.1 g/t Au & 3.4 g/t Ag over 20.6 m

- iCHU23-16:

- 6.9 g/t Au & 3.9 g/t Ag over 8.8 m

- 11.1 g/t Au & 3.4 g/t Ag over 3.3 m

- 12.5 g/t Au & 6.5 g/t Ag over 11.5 m

Ruby Hill

During the third quarter of 2023, drilling at Ruby Hill was focused on advancing exploration and delineation of multiple CRD mineralized discoveries. Definition and expansion drilling of high-grade polymetallic mineralization along the Hilltop fault structure remains a priority. 7,565 feet of core drilling and 780 feet of RC drilling was completed during the quarter. In addition to drilling at Hilltop, multiple holes are being drilled for infill of the Blackjack Zone. Drilling highlights for the quarter include:

Tyche Discovery

- iRH23-18A: 45.4 g/t Au & 50.2 g/t Ag over 17.5 m including 95.9 g/t Au & 65.6 g/t Ag over 7.6 m

East Hilltop Skarn

- 12.5 % Zn & 5.7 g/t Ag over 5.0 m (iRH23-16)

- 12.8 % Zn & 4.6 g/t Ag over 10.7 m (iRH23-16A)

- 11.6 % Zn & 5.8 g/t Ag over 6.1 m AND 14.7 % Zn & 3.7 g/t Ag over 4.6 m (iRH23-27)

- 20.8 % Zn & 15.0 g/t Ag over 11.6 m (iRH23-30)

Blackjack

- 10.7 % Zn & 37.0 g/t Ag over 47.9 m (iRH23-41 – skarn)

- 15.6 % Zn, 8.7 % Pb, 420.4 g/t Ag & 0.6 g/t Au over 40.4 m (iRH23-41 – CRD)

Gold Mineralized Zones

- 6.9 g/t Au over 50.7 m including 8.0 g/t Au over 24.9 m (iRH23-40) – Ruby Deeps

- 9.1 g/t Au over 10.2 m (iRH23-41) – Lower Jack

Residual leaching activities at Ruby Hill produced and sold 1,910 ounces of gold during the quarter and 4,781 ounces of gold YTD at a realized gold price of $1,860 and $1,885 per ounce sold1, respectively.

The Company will hold a conference call and webcast on November 2, 2023, commencing at 10:00 am ET to discuss its third quarter results and answer questions from participants.

Conference Call Participant Details

Webcast URL: https://app.webinar.net/lj3rwk6AaKq

Phone Number Information:

North American Toll-free: 1-888-664-6383

Local Toronto: 1-416-764-8650

Qualified Persons

Tyler Hill, CPG-12146, Chief Geologist, and Tim George, PE, Mining Operations Manager, at i-80 have reviewed this press release and are the Qualified Persons for the information contained herein and are a “Qualified Person” within the meaning of National Instrument 43-101.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company’s advanced-stage property portfolio with processing at i-80’s centralized milling facilities. i-80 Gold’s common shares are listed on the TSX and the NYSE American under the trading symbol IAU:TSX and IAUX:NYSE. Further information about i-80 Gold’s portfolio of assets and long-term growth strategy is available at www.i80gold.com or by email at info@i80gold.com.

For further information, please contact:

Ewan Downie – CEO

Ryan Snow – CFO

Matt Gili – President & COO

Matthew Gollat – Executive Vice-President

1.866.525.6450

Info@i80gold.com

Forward-looking information

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including but not limited to, actual production results and costs, results of operation outcomes and timing of updated technical studies at the Company’s mineral projects, timing to advance mineral projects to production and advance permitting and feasibility work on its mineral projects and future production, development and exploration results. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labor unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to i-80’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

The Company has included certain terms or performance measures commonly used in the mining industry that are not defined under IFRS in this document. These include: adjusted net earnings and average realized price per ounce. Non-IFRS financial performance measures do not have any standardized meaning prescribed under IFRS, and therefore, they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and should be read in conjunction with the Company’s Financial Statements.

Definitions

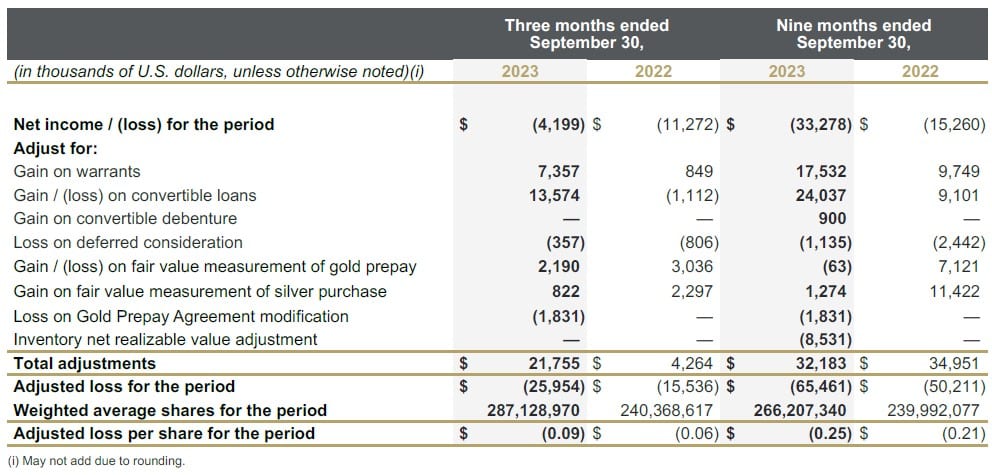

Adjusted earnings / (loss) and adjusted earnings / (loss) per share excludes from net earnings / (loss) significant write-down adjustments and the gain / (loss) from financing instruments.

Average realized gold price represents the sales price of gold per ounce before deducting mining royalties, treatment and refining charges and gains or losses derived from the offtake agreement with Orion.

Average realized gold price per ounce of gold sold

Average realized gold price per ounce of gold sold is a non-IFRS measure and does not constitute a measure recognized by IFRS and does not have a standardized meaning defined by IFRS. It may not be comparable to information in other gold producers’ reports and filings.

Adjusted Earnings / (Loss)

Adjusted earnings / (loss) and adjusted earnings / (loss) per share are non-IFRS measures that the Company considers to better reflect normalized earnings because it eliminates non-recurring items. Certain items that become applicable in a period may be adjusted for, with the Company retroactively presenting comparable periods with an adjustment for such items and conversely, items no longer applicable may be removed from the calculation. Neither adjusted earnings / (loss) nor adjusted earnings / (loss) per share have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies.

The following table shows a reconciliation of adjusted earnings / (loss) for the three and nine months ended September 30, 2023 and 2022, to the net earnings / (loss) for each period.

1 Specified financial measure which is not a standardized measure under IFRS and may not be comparable to similar specified financial measures used by other entities. Please see “Non-IFRS Financial Performance Measures” for the composition of such specified financial measure, an explanation of how such specified financial measure provides useful information to a reader and the purposes for which management of i-80 uses the specified financial measure, and where required, a reconciliation of the specified financial measure to the most directly comparable IFRS measure.